Meet Drevis and Josie

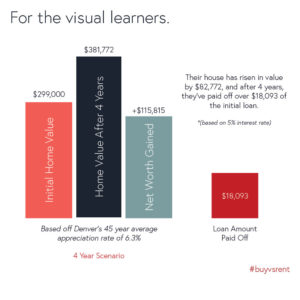

With each monthly payment, they are gradually paying off their mortgage loan, owning a larger percentage of their house, and accumulating net worth. For this example, we’re going to identify how Drevis and Josie have built over $115,098 in Equity over 4 years.

Drevis and Josie purchased their home for $299,000.

In order to buy the home, they had to pay a down payment; which is an initial payment made when something is bought on credit. A bank or other financial institution then covers the remainder of the costs through a mortgage loan.

Down payments typically range anywhere from 3 to 25 percent of the total home value. In this instance, they paid a 5% down payment – totaling $14,950. Their lender covered the rest and their final loan amount was for $284,050With a 30yr conventional loan at a 5% interest rate, their monthly payments are $1,946 per month – this total mortgage payment includes: (Principal, Interest, Mortgage Insurance, Taxes, Property Insurance, and HOA costs)After 4 years (48 payments) Drevis and Josie have ultimately spent over $93,408 ($1,946 x 48)

Unfortunately, not all of that has gone towards the principal of the loan, most of it has gone towards paying off the interest of the loan, which doesn’t build equity. BUT every month, a portion of their mortgage has gone towards the principal amount of the loan, through which they have been building equity!

We know this is confusing, luckily there are many resources available to guide you throughout the home buying process!

$284,050 – initial loan amount- $18,093 – total allocated towards principal after 4 years

$265,957 – total amount left on the loan (initial loan amount – principal amount paid off)

Home Value Appreciation: Based on Denver’s 45 year average 6.3% appreciation rate

Year 0: $299,000

Year 1: $317,837

Year 2: $337,860

Year 3: $359,145

Year 4: $381,772

Value Appreciation = $82,772

New Home Value = $381,772

Loan amount left = -$265,957

Equity Earned = $115, 815+

Equity can be defined as: the value of a mortgaged property after deduction of charges against it. Which means, the current value of the property minus the amount still owed on the property.

Now lets compare Drevis and Josie to Andrew, who just signed a lease for a 1 bedroom apartment in Denver.

Meet Andrew

$1,850 is the average rental rate for a 1 bedroom apartment in the Denver University neighborhood.

His $1,850 rent check goes straight into his landlord’s pocket – he’s essentially throwing it away.If Andrew lives at his current address for 4 years (48 months), he’ll have spent a total of $88,800 on rent.

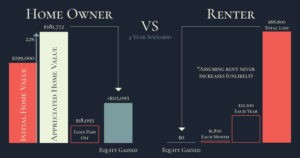

Total Monthly Payments after 4 years:

Drevis and Josie: $93,408.

Andrew: $88,800

At first glance it seems that Andrew is saving money compared to Drevis and Josie. But, there’s more to it that total expenses. We’ll show you why Drevis and Josie are much smarter than Andrew.

Andrew’s $88,800 rent check is $88,800 Andrew will never see again, and it doesn’t go towards anything.https://redthomes.squarespace.com/blog/why-it-makes-sense-to-buy-vs-rent-even-in-this-market-2019

As a renter, Andrew is building zero equity and not accumulating any net worth.

Here’s the Reality

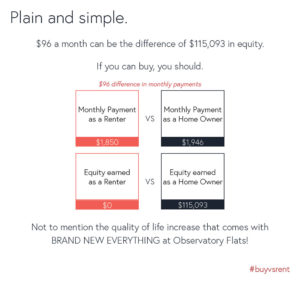

It is smart and financially responsible to buy instead of rent if you can.After 4 years:Andrew has lost $88,800. Drevis and Josie have gained $115,815 in equity. As home-owners, Drevis and Josie have gained $115,815 in net worth. As a renter, Andrew has lost $88,800Their monthly payments are nearly the same. For a similar amount of money, Andrew could be creating a wealth strategy and investing in his future, but he’s not.

Which should make it clear:

If you can buy a home, you should. It’s the financially smart thing to do.redT Homes is the brokerage of a variety of great for-sale options throughout the Denver Metro Area. Contact us today to find the best option for you!

(720) 402-4385